World Logistic

Mobile APP

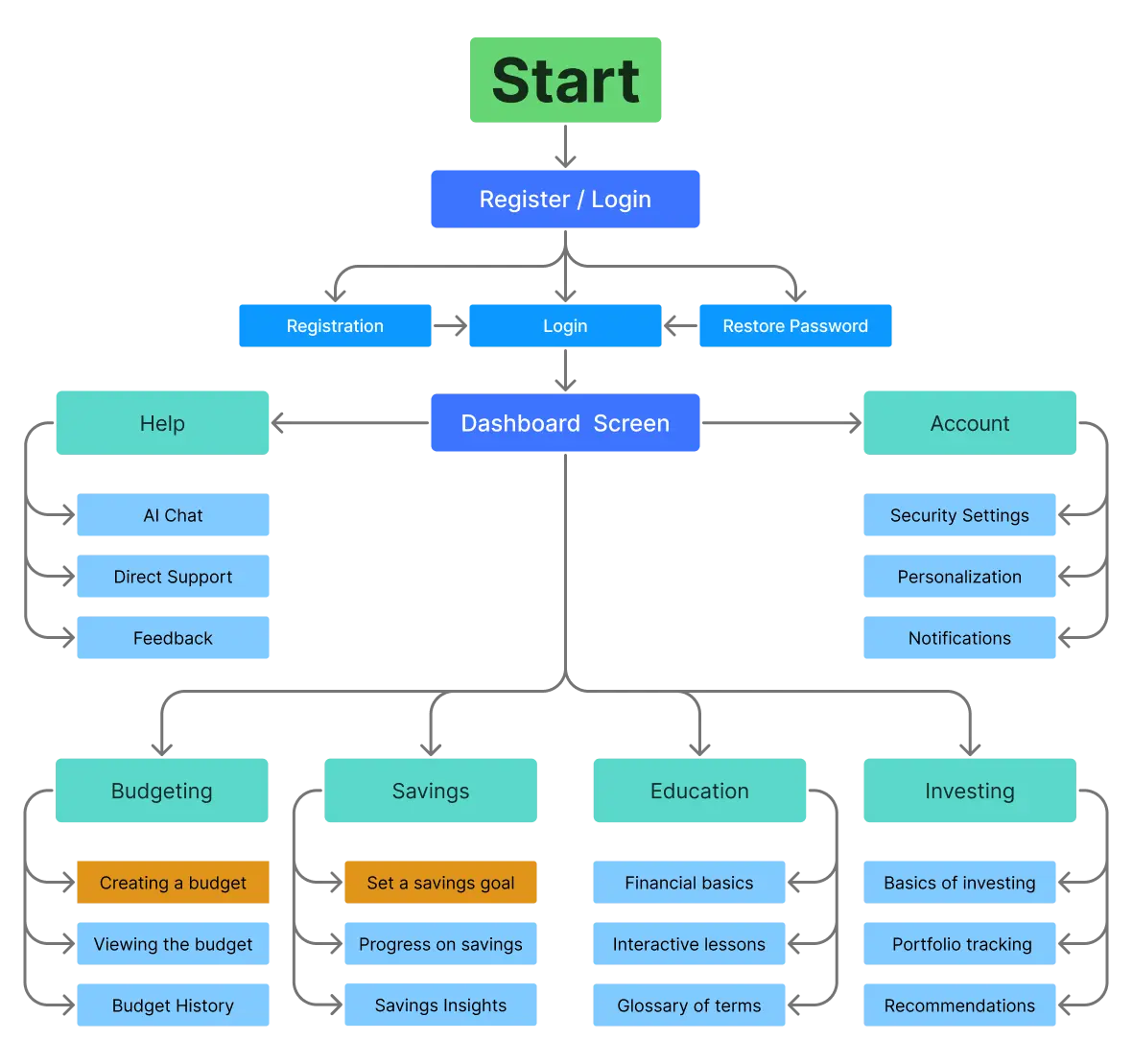

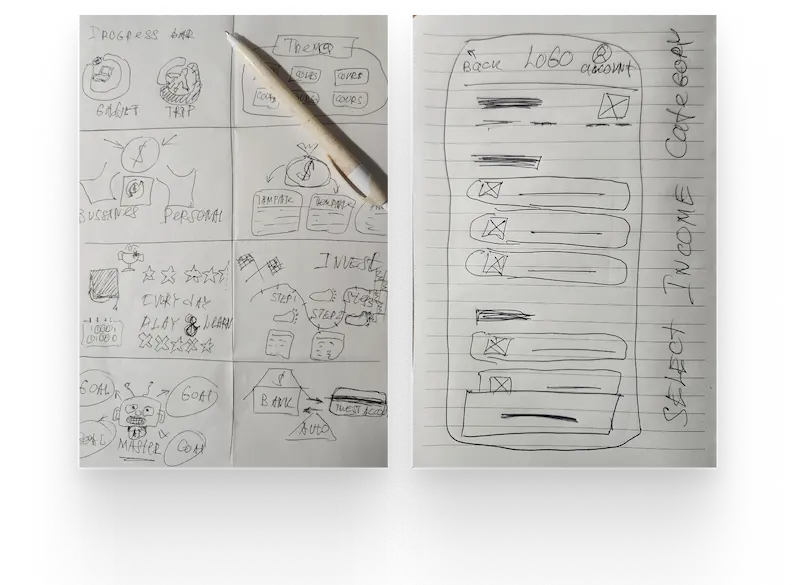

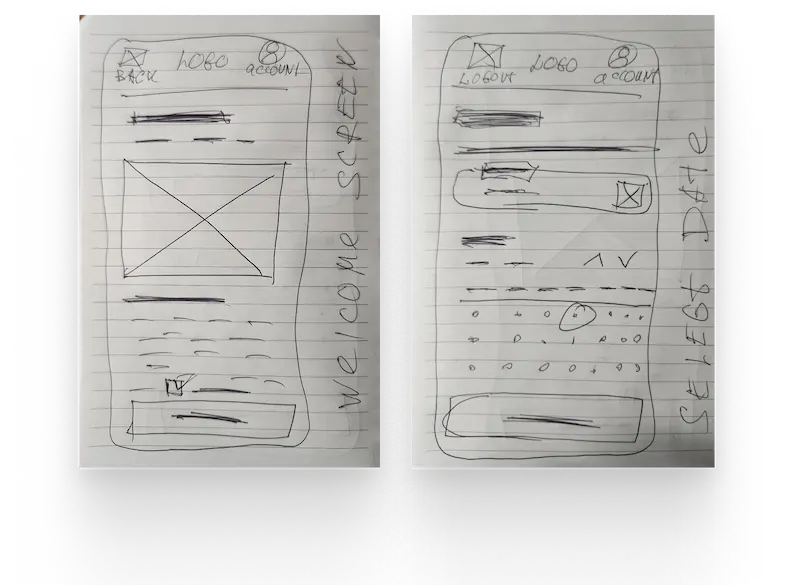

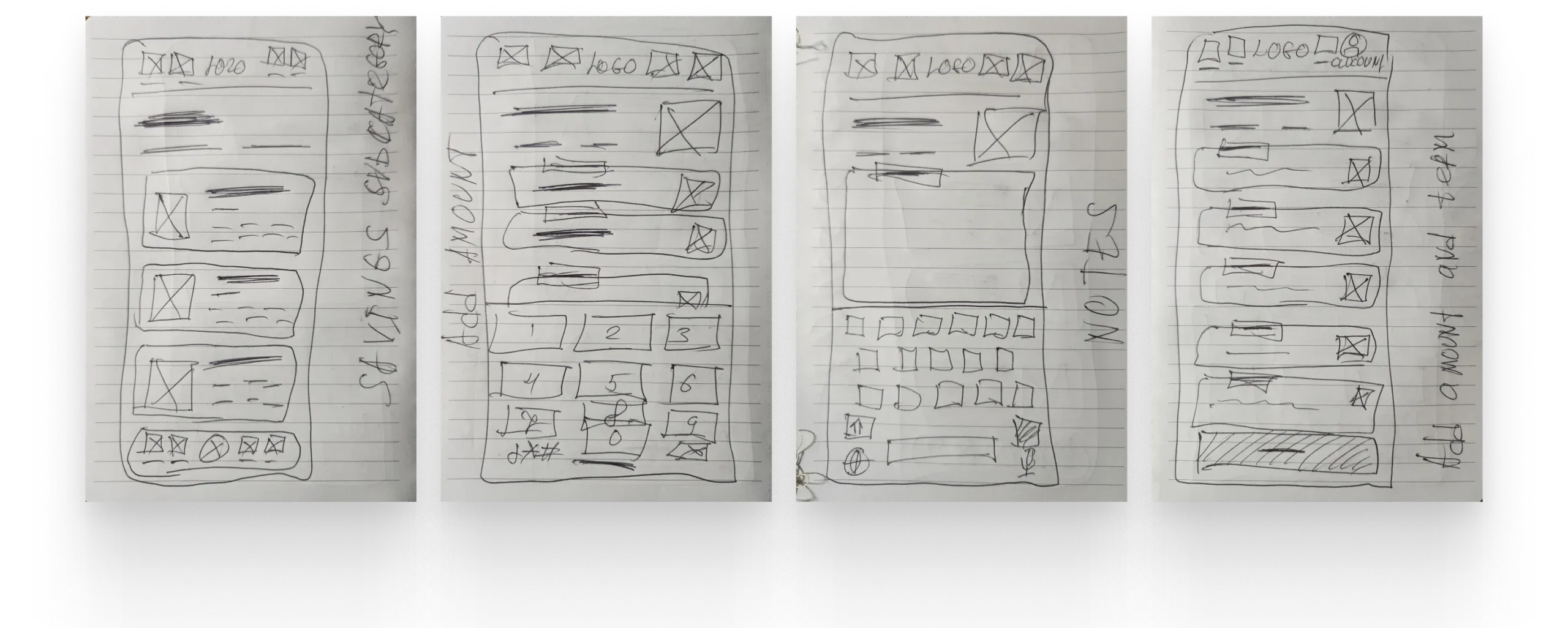

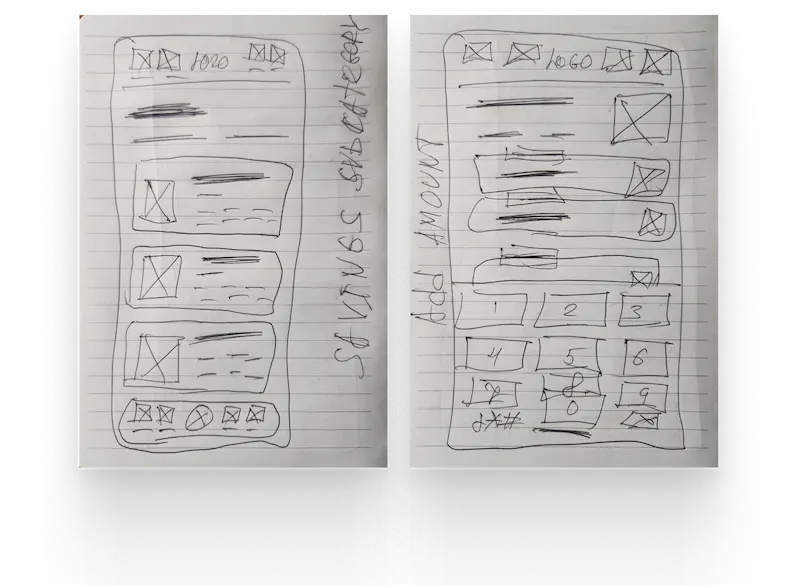

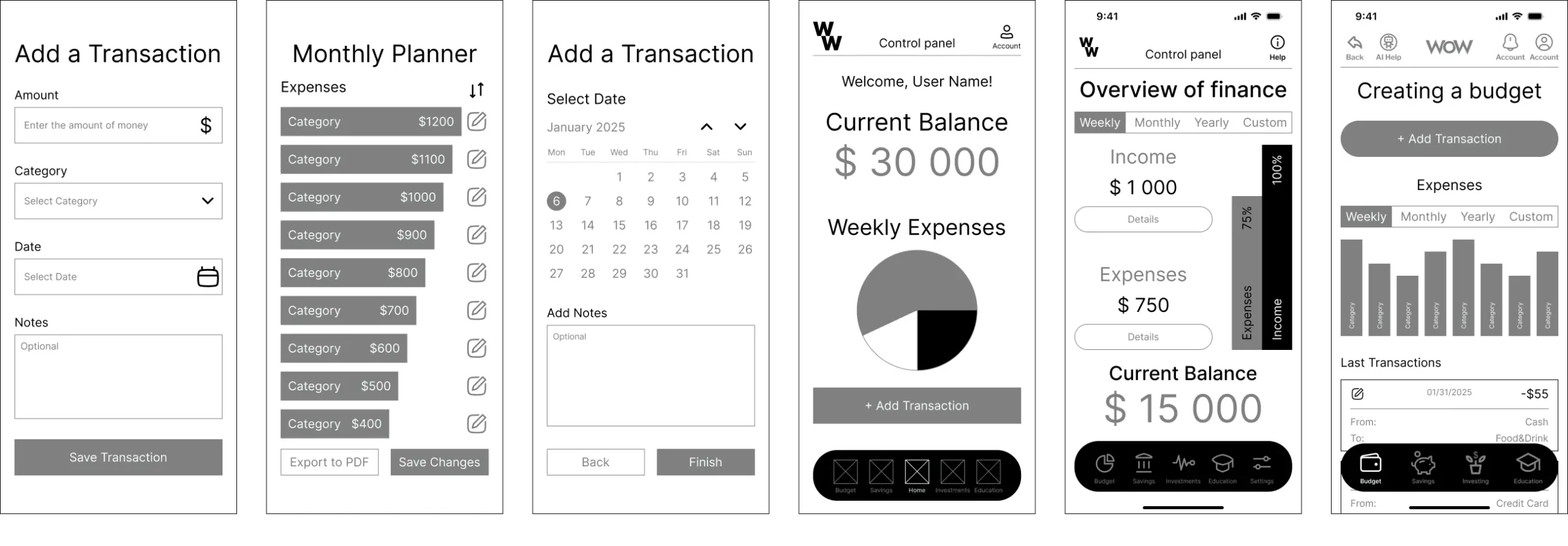

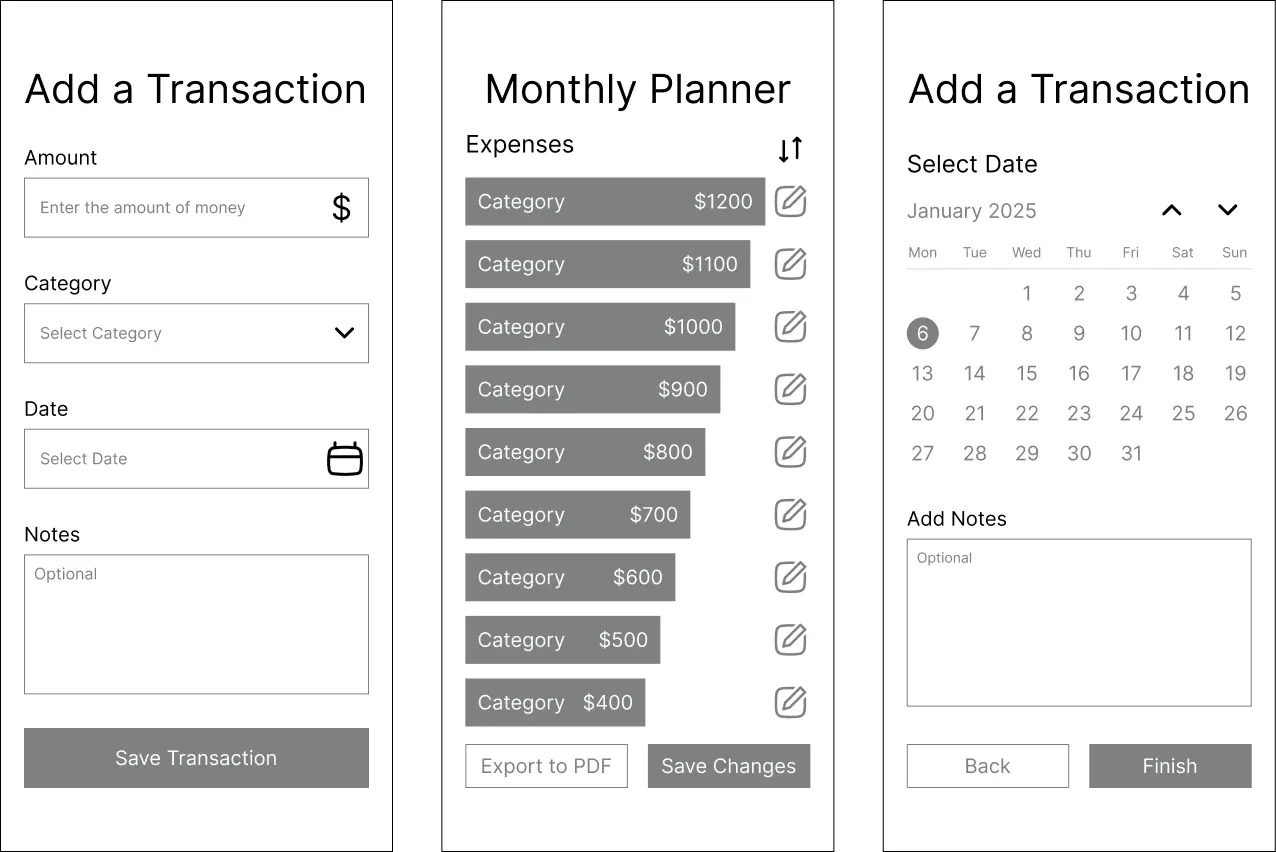

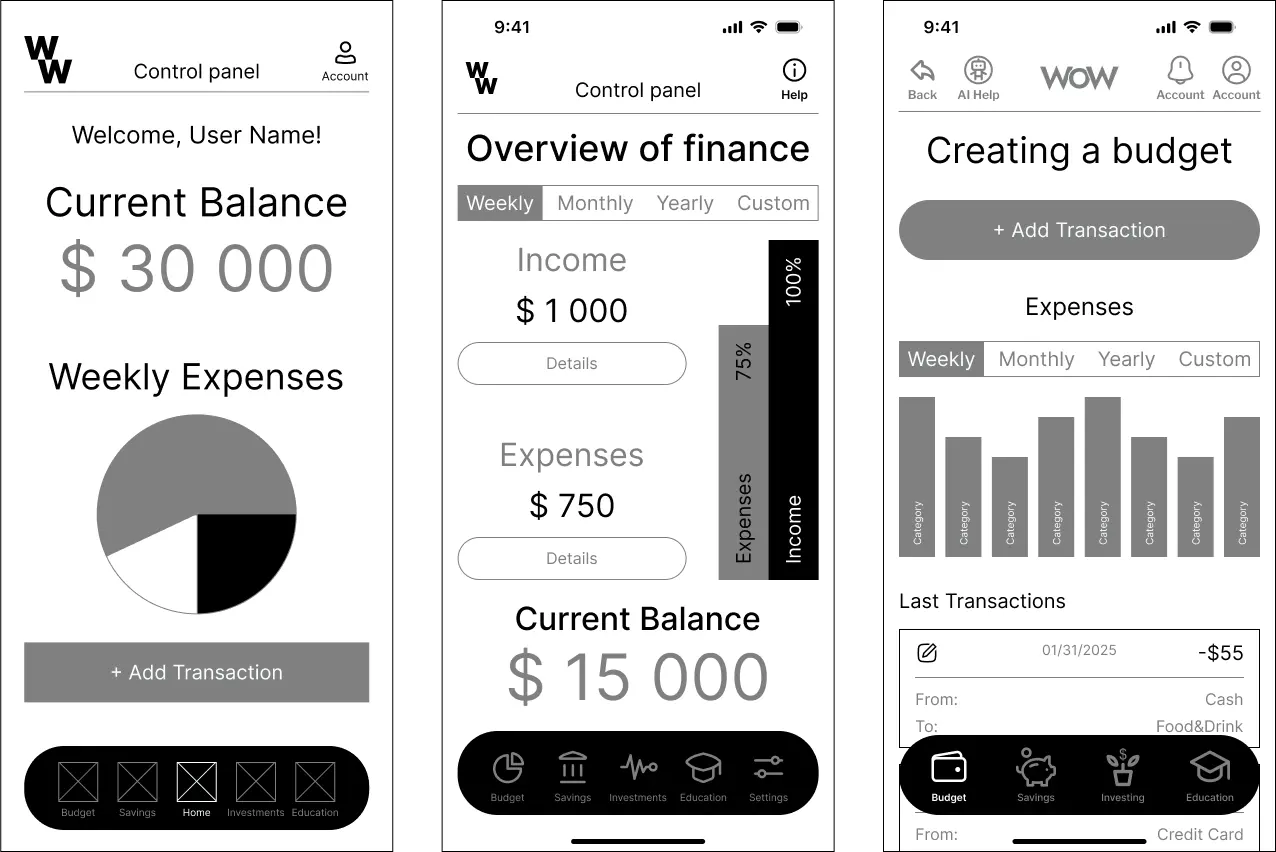

Mobile app designed to help young adults build essential financial skills like budgeting, saving, and investing — all through gamified, story-driven experiences. The app combines educational tools, interactive tasks, and personalized guidance, making financial literacy approachable, engaging, and even fun.

Research shows that 85–95% of young people aged 18–24 use smartphones as their main device. Based on this, I’m creating a mobile app that helps young adult users build essential financial skills — like budgeting, saving, and goal planning — through interactive simulations, gamified tasks, and rewards.

Many young people struggle with managing their personal finances due to a lack of engaging, accessible, and practical financial education. Traditional budgeting tools are either too complex, too dry, or fail to motivate long-term financial behavior change.

It is the combination of personalized financial learning with playful, scenario-based simulations and an experience modeled after habit-forming, gamified platforms like Duolingo and Habitica.

# 1 About current experience and approach to finance

# 2 About financial habits and hardships

# 3 About motivation and learning needs

# 4 About expectations from the interface and functionality

# 5 About application format and style preferences

# 6 About Social Elements and Feedback

Insight Supporting Quote Users feel overwhelmed by budgeting apps “I never know where to start — it’s too complicated.” They want financial tools that are fun and easy to use “If it looked more like a game, I’d actually use it.” They struggle to stay motivated “I usually give up after the first week.”

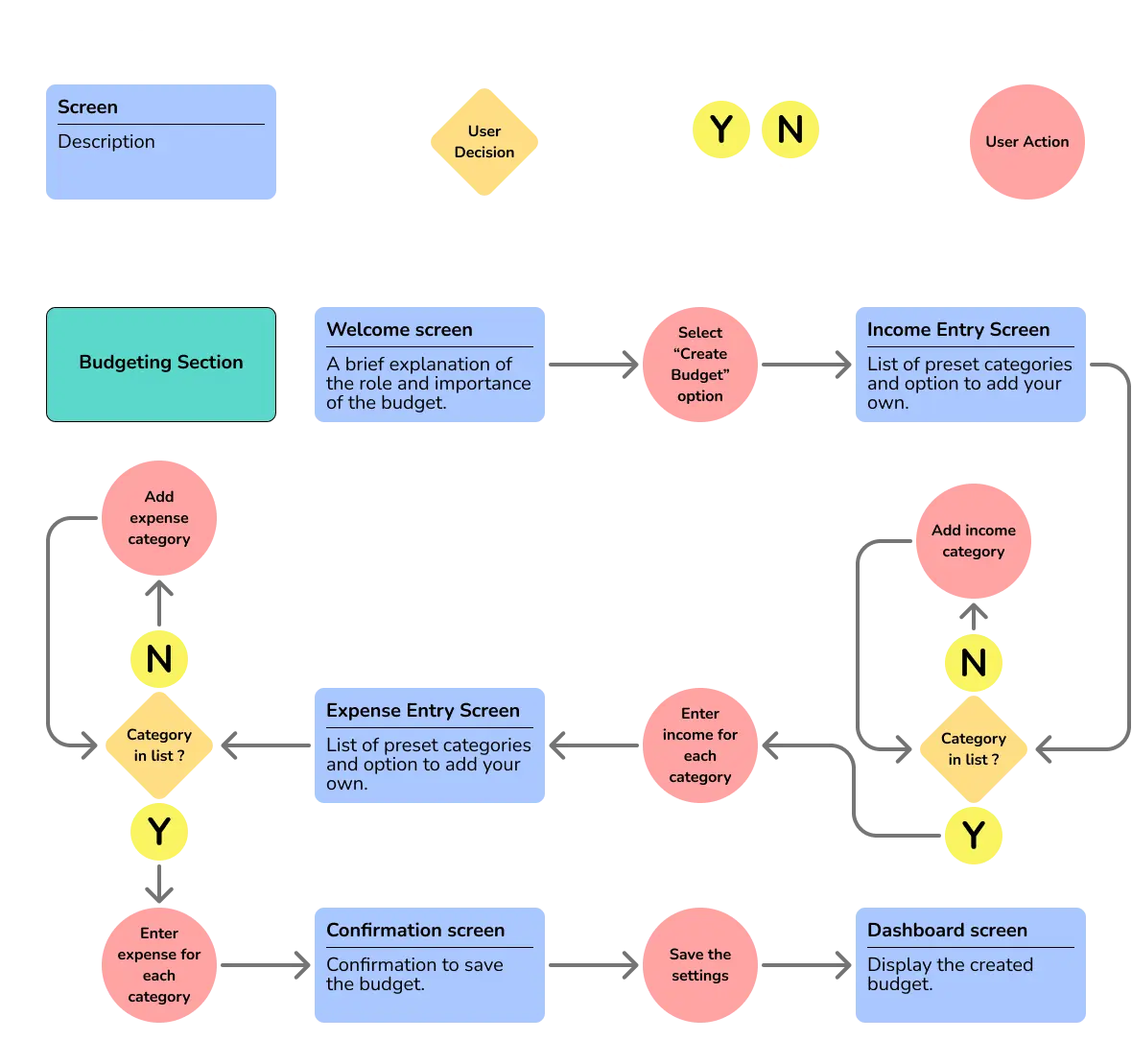

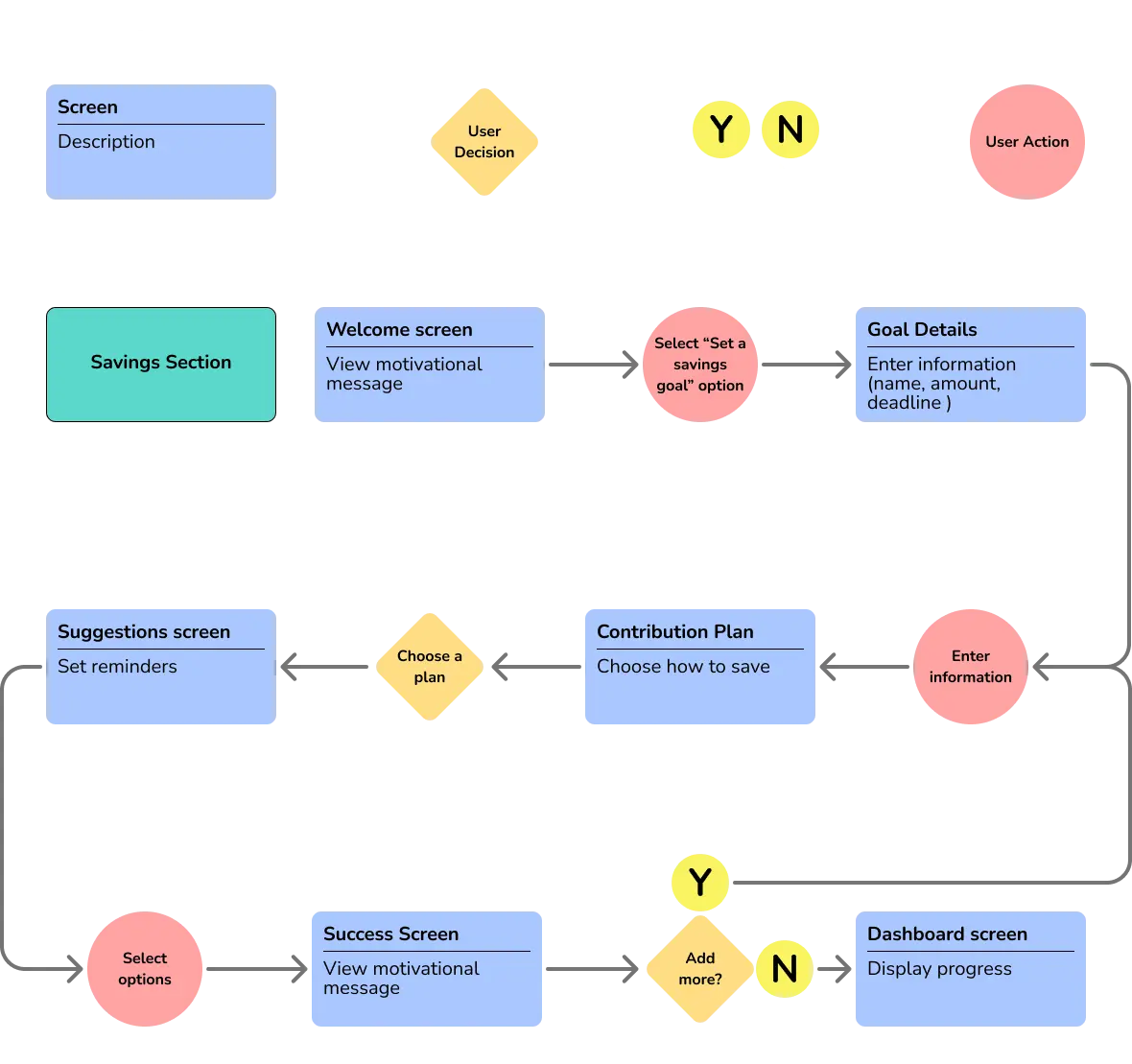

Problem Solution Budgeting feels overwhelming Step-by-step guide in the app Financial tools are boring or confusing Playful, gamified UI and characters to make it feel friendly Lack of motivation Visual savings goals and rewards to keep users engaged

She just moved into a dorm and is managing her own money for the first time. She's worried about overspending on entertainment and wants to save for big purchases. She’s tried budget apps before, but they felt confusing.

He got his first job after university and wants to manage his income wisely. He keeps a basic budget in Excel, but feels it's not enough. Now looking for an app with gamification to help understand investments.

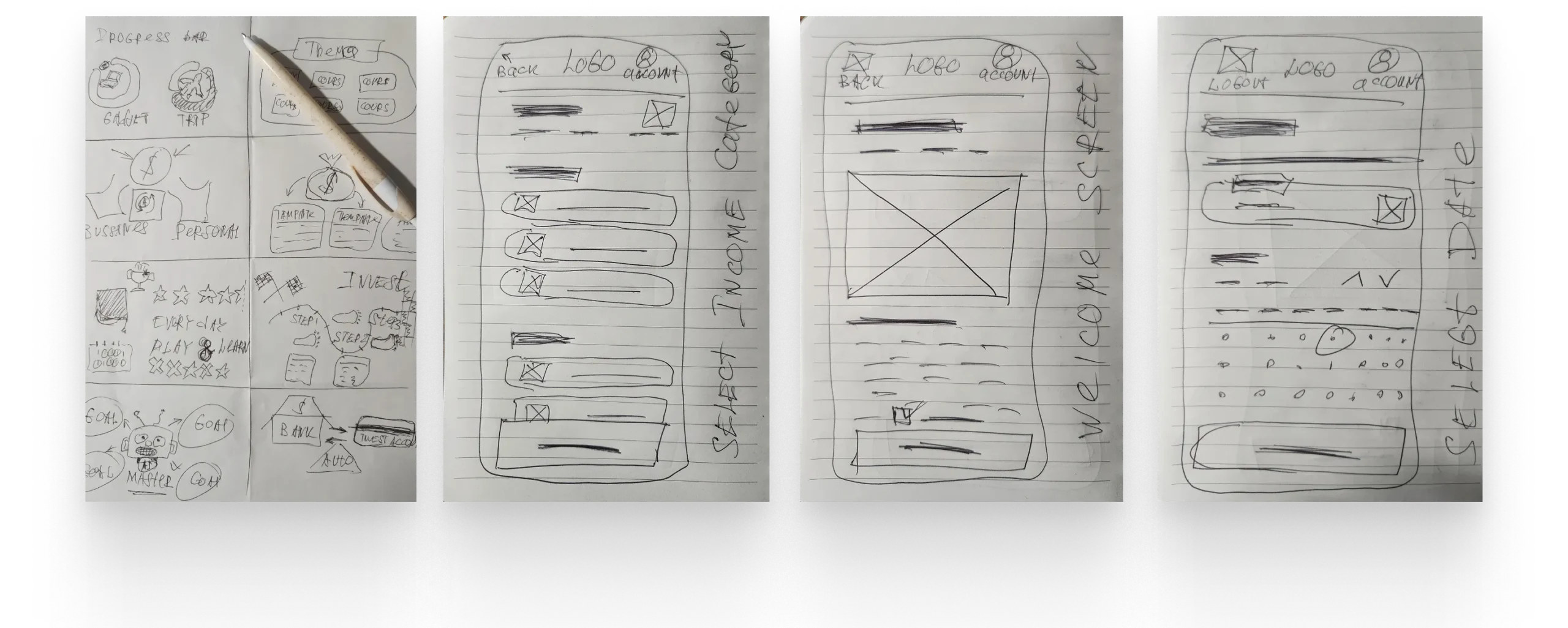

I learned how to understand real user needs, turn their struggles into design opportunities, and create solutions that are both useful and fun. This project helped me improve my skills in research, ideation, and visual design.

Next, I’d like to build a full prototype and test it with real users. With the right support, I’d work with developers and financial experts to launch the app and help more young people feel confident about money.